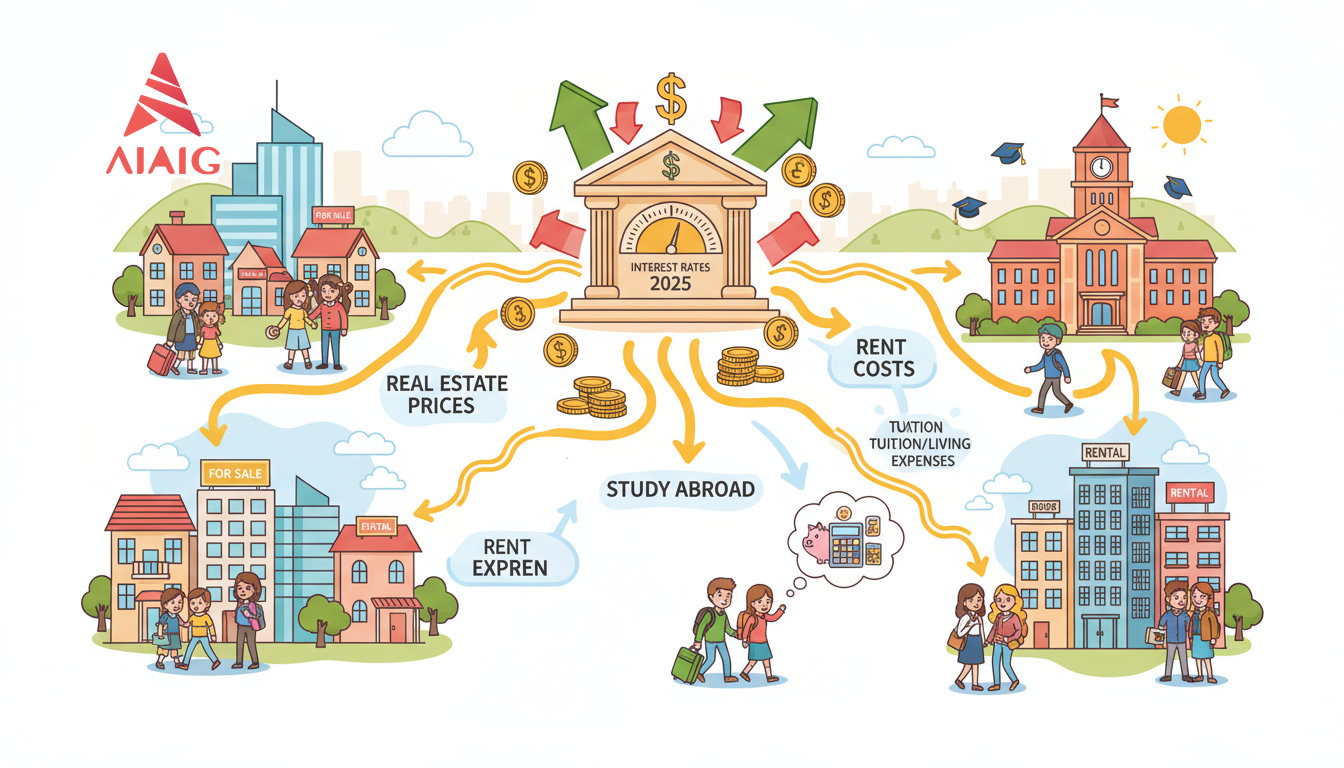

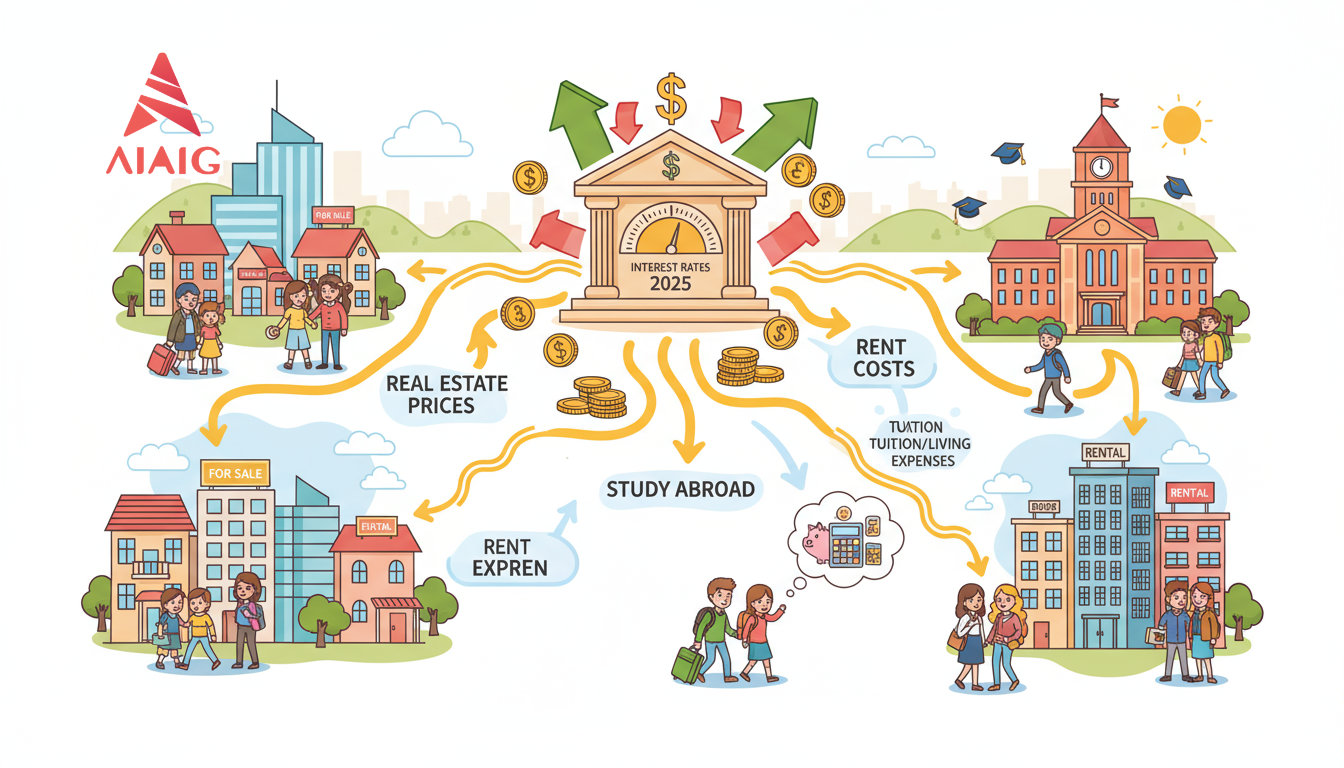

2025 Latest Deposit Interest Rates Summary and Discussion (Part 1)

Focusing on current and fixed deposit interest rates and macro policies (including exchange rates) from early 2025 to the present, and systematically evaluating their impact and strategic recommendations on real estate, rent, and study abroad costs/trends in Japan, Singapore, Thailand, and Vietnam.